Life Insurance vs Term Insurance – Complete Comparison Guide

Choosing between life insurance vs term insurance is one of the most critical financial decisions for individuals and families in the United States. Insurance is not just about planning for death; it is about protecting income, preserving dignity, securing dependents, and ensuring that financial responsibilities do not collapse when life takes an unexpected turn. A single insurance decision can determine whether a family remains financially stable or struggles for years.

In the USA, millions of people buy insurance every year, yet a large percentage of them are not fully aware of what they are purchasing. Some people buy expensive life insurance policies believing they are making an “investment,” while others avoid insurance altogether thinking it is unnecessary. The confusion around life insurance vs term insurance exists mainly because both products are marketed aggressively but explained poorly.

This guide is designed to remove that confusion. It explains life insurance vs term insurance in simple, practical language, focusing on real-life use cases instead of sales pitches. By the end of this article, you will clearly understand which policy suits your financial situation, life stage, and long-term goals.

What Is Life Insurance?

Life insurance is a long-term agreement between an individual and an insurance company where the insurer promises to pay a death benefit to the policyholder’s beneficiaries in exchange for regular premium payments. In the United States, life insurance is often used as a financial safety net for families, ensuring that loved ones are not left struggling with expenses, debts, or loss of income.

Unlike short-term coverage options, most life insurance policies are designed to last for the entire lifetime of the insured person. As long as premiums are paid, the policy remains active, regardless of age or health changes. This permanence makes life insurance particularly useful for long-term planning and estate-related needs.

Life insurance is not only about replacing income. It also plays a role in covering funeral costs, settling estate taxes, paying off final medical bills, and leaving a financial legacy for children or spouses.

Life insurance in the United States is regulated and standardized under federal and state insurance laws to protect consumers and ensure transparency.

Cash Value Component in Life Insurance

One of the most important features that separates life insurance from term insurance is the cash value component. Certain life insurance policies, such as whole life and universal life insurance, accumulate cash value over time. A portion of every premium paid is allocated toward this cash value account.

This cash value grows slowly and steadily, often on a tax-deferred basis in the USA. Over time, policyholders may borrow against it, withdraw a portion, or use it as collateral. Some people use cash value for emergency expenses, retirement supplements, or funding education costs.

However, this benefit is not free. Because life insurance combines protection with savings, premiums are significantly higher than term insurance. Many policyholders do not fully utilize the cash value feature, making the high cost unjustified for their actual needs.

What Is Term Insurance?

Term insurance, commonly referred to as term life insurance, is the most straightforward form of life coverage available in the United States. It provides financial protection for a specific period, such as 10, 20, or 30 years. If the insured person passes away during this period, the insurance company pays the death benefit to the beneficiaries.

If the policyholder survives the policy term, the coverage simply ends, and no payout is made. This is often misunderstood as a disadvantage, but in reality, term insurance is designed for protection, not returns.

Term insurance does not include savings, investments, or cash value accumulation. Its only purpose is to protect dependents during years when financial responsibilities are highest.

Term life insurance is widely used in the USA because it offers affordable coverage for a fixed period with no investment component.(Detailed explanation available on Investopedia)

Why Term Insurance Is So Popular in the USA

Term insurance is popular in the USA because it aligns perfectly with real-life financial needs. During working years, people have mortgages, car loans, children’s education expenses, and household costs. Term insurance provides high coverage at a low cost, ensuring that these responsibilities are covered if something unexpected happens.

Another reason for its popularity is transparency. Term insurance is easy to understand, easy to compare, and free from complex clauses related to investments or returns. This simplicity makes it the preferred choice for financial planners and advisors.

Click to know… How to Build Credit Score in USA From Scratch 2025

Types of Life Insurance Available in the USA

Understanding the different types of life insurance is essential when comparing life insurance vs term insurance, as each type serves a distinct purpose.

Term Life Insurance

Term life insurance provides coverage for a fixed duration and does not build cash value. It is primarily used for income replacement and debt protection. It is best suited for young families, first-time buyers, and people with limited budgets.

Whole Life Insurance

Whole life insurance offers lifetime coverage with fixed premiums. It builds guaranteed cash value over time and provides predictable benefits. Whole life insurance is often chosen for estate planning, inheritance planning, and individuals who want guaranteed lifelong protection.

However, whole life insurance premiums are high, and returns on cash value are generally lower than traditional investment options.

Universal Life Insurance

Universal life insurance provides flexibility in both premiums and death benefits. Policyholders can increase or decrease payments depending on income and financial needs. This flexibility can be useful for business owners or people with variable income, but it also adds complexity.

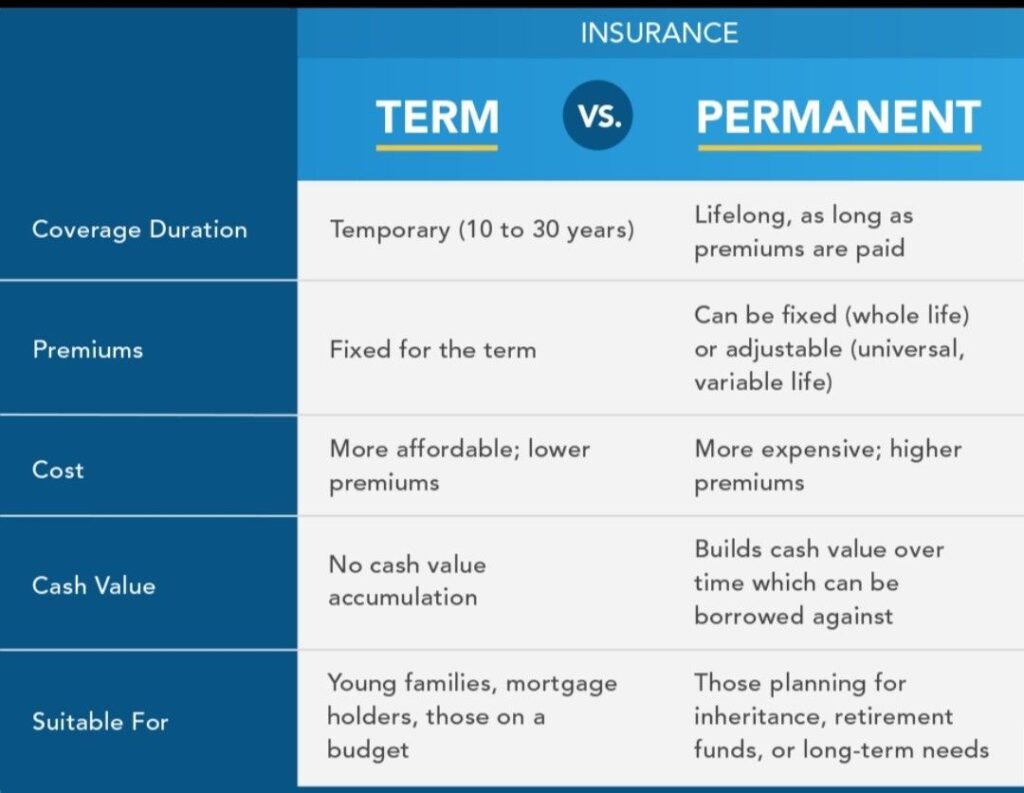

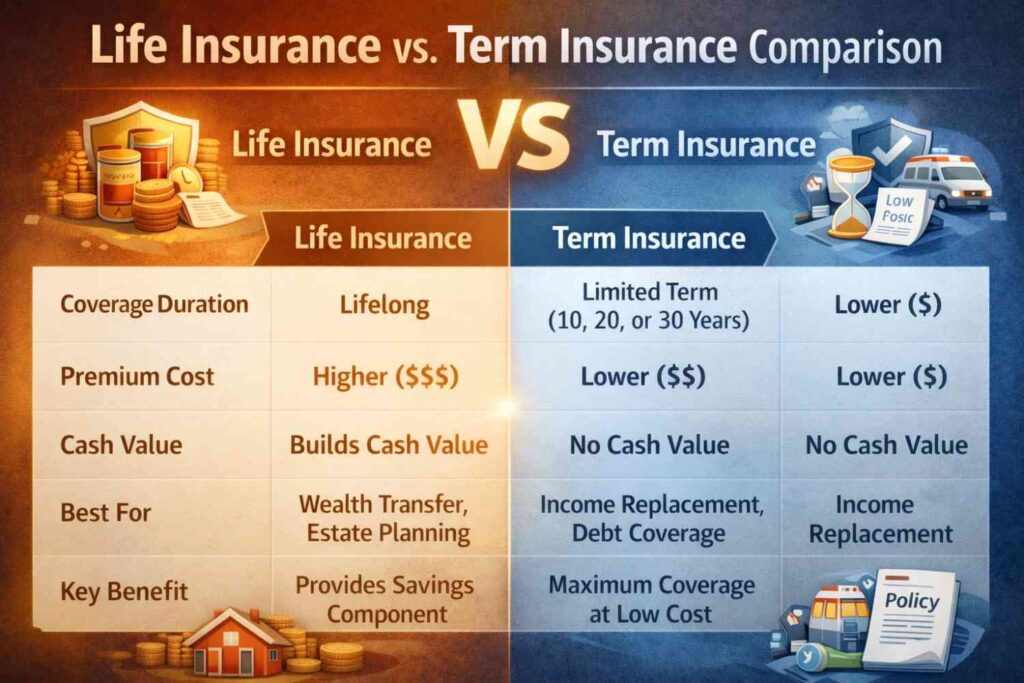

Life Insurance vs Term Insurance: Key Differences

The primary differences between life insurance vs term insurance revolve around duration, cost, and purpose.

Coverage Duration

Term insurance provides coverage for a limited time, usually tied to financial responsibilities. Life insurance provides coverage for the insured person’s entire life, regardless of age.

Cost Structure

Term insurance is affordable and accessible. Life insurance is significantly more expensive due to lifetime coverage and additional features such as cash value accumulation.

Purpose of Coverage

Term insurance focuses purely on protection and income replacement. Life insurance combines protection with long-term financial planning and wealth preservation.

Cost Comparison: Life Insurance vs Term Insurance in the USA

Cost is one of the biggest deciding factors when choosing between life insurance and term insurance. In the USA, a healthy individual in their early 30s can secure a high-value term insurance policy at a very low monthly premium. This allows families to get maximum protection without straining their budget.

In contrast, permanent life insurance policies can cost five to ten times more for the same coverage amount. These higher premiums are due to administrative costs, long-term guarantees, and the cash value component.

For most households, especially middle-income families, term insurance offers better value and flexibility.

Click to know..Best Health Insurance Policy in USA 2025: Plans,Costs,Eligibility

Who Should Choose Term Insurance?

Term insurance is ideal for people who want strong financial protection at an affordable cost. It is particularly suitable for young professionals, married couples, parents with dependent children, and homeowners with long-term mortgages.

Financial experts in the USA often recommend term insurance as the foundation of any insurance strategy. It provides peace of mind without locking policyholders into expensive, long-term commitments.

Who Should Choose Life Insurance?

Life insurance is more appropriate for individuals with specific long-term financial goals. Business owners, high-income earners, and people involved in estate planning may benefit from permanent life insurance policies.

Life insurance can also be useful for those who want to leave a guaranteed inheritance or manage wealth transfer efficiently. However, it should be chosen only after careful analysis of costs and benefits.

Life Insurance vs Term Insurance for Different Life Stages

Young Adults

For individuals in their 20s and early 30s, term insurance is usually the best option. Premiums are low, coverage is high, and financial responsibilities are typically temporary.

Families With Children

Term insurance ensures that children’s education, daily expenses, and future needs are financially protected even if the primary earner is no longer present.

Mid-Career Professionals

Some professionals may combine term insurance with a small permanent policy to balance protection and long-term planning.

Retirees

Life insurance can help cover final expenses, estate taxes, and inheritance planning, especially when other assets are illiquid.

Click to Know..Best High-Yield Savings Accounts in USA: Highest APY Rates, Top Banks & Features

Tax Benefits of Life Insurance vs Term Insurance in the USA

In the USA, death benefits from both term insurance and life insurance are generally tax-free for beneficiaries. Life insurance offers additional tax advantages such as tax-deferred cash value growth and tax-advantaged policy loans.

Term insurance does not provide savings-related tax benefits but still offers tax-free death benefits.

Advantages and Disadvantages of Term Insurance

Advantages of Term Insurance

Term insurance is affordable, easy to understand, and provides high coverage. It allows families to allocate more money toward investments and savings instead of high insurance premiums.

Disadvantages of Term Insurance

Term insurance does not build cash value, and coverage ends after the policy term expires. Renewal premiums can be high if coverage is extended later in life.

Advantages and Disadvantages of Life Insurance

Advantages of Life Insurance

Life insurance provides lifelong coverage, supports estate planning, and offers predictable benefits. It can act as a financial backup for long-term goals.

Disadvantages of Life Insurance

High premiums, complex structures, and lower investment returns make life insurance unsuitable for many first-time buyers.

Click to know..Best Personal Loans in USA 2025 Rates, Lenders & Guide

Common Mistakes People Make While Buying Insurance

Many people delay buying insurance until premiums become expensive, buy coverage based on returns instead of protection, or underestimate their coverage needs. Others rely solely on employer-provided insurance, which may not be sufficient.

Avoiding these mistakes ensures that insurance fulfills its true purpose.

Consumers in the USA are advised to review policy terms carefully and understand insurer obligations before purchasing insurance.

(Guidelines provided by NAIC)

How Much Coverage Do You Actually Need?

A commonly followed guideline in the USA is to buy insurance coverage equal to 10 to 15 times annual income. However, actual needs depend on dependents, debts, lifestyle, and future goals.

Term insurance makes it easier to achieve adequate coverage without financial strain.

Life Insurance vs Term Insurance: Which One Is Better?

There is no universal answer to this question. For most working families, term insurance offers better value and flexibility. Life insurance becomes relevant when long-term financial planning, estate management, and wealth transfer are priorities.

The best approach is to align insurance choices with real-life needs instead of marketing promises.

Click to know…How to Control Overspending: Best Practical Ways to Stop Spending Money & Save More

Frequently Asked Questions (FAQ) – Life Insurance vs Term Insurance

1.What is the main difference between life insurance and term insurance?

The main difference between life insurance and term insurance lies in the duration and purpose of coverage. Term insurance provides protection for a fixed period such as 10, 20, or 30 years and focuses only on income replacement. Life insurance usually provides lifelong coverage and may include a cash value or savings component. Term insurance is affordable and simple, while life insurance is more expensive and designed for long-term financial planning.

2.Is term insurance better than life insurance in the USA?

For most working individuals and families in the USA, term insurance is considered better because it offers high coverage at a low cost. It is ideal for protecting income, mortgages, and family expenses during earning years. Life insurance may be better only for people with specific long-term goals such as estate planning, wealth transfer, or guaranteed inheritance.

3.Why do financial experts recommend term insurance first?

Financial experts recommend term insurance first because it provides maximum financial protection without putting pressure on monthly budgets. It allows individuals to secure their family’s future while investing the remaining money in higher-return options such as retirement accounts, mutual funds, or stocks. Term insurance focuses on protection, which is the primary purpose of insurance.

4.Does term insurance give any money back after maturity?

No, term insurance does not provide any payout if the policyholder survives the policy term. This is often misunderstood as a disadvantage. In reality, term insurance is designed purely for protection, not returns. If the policyholder survives, it means the insurance successfully did its job by providing peace of mind during risky years.

5.Is life insurance a good investment option?

Life insurance should not be viewed as a primary investment option. While some life insurance policies build cash value, the returns are generally lower compared to traditional investments like index funds or retirement plans. Life insurance is better suited for protection and long-term financial stability rather than wealth creation.

6.Can I convert term insurance into life insurance later?

Many term insurance policies in the USA come with a conversion option that allows policyholders to convert term insurance into permanent life insurance without a medical exam. This option can be useful if financial goals change later in life. However, converted policies usually come with higher premiums.

7.At what age should I buy term insurance?

The best time to buy term insurance is as early as possible, preferably in your 20s or early 30s. Buying early results in lower premiums and better coverage options. Waiting too long can increase costs significantly due to age and health conditions.

8.How much term insurance coverage do I need?

A commonly used guideline is to buy coverage equal to 10 to 15 times your annual income. However, actual coverage needs depend on factors such as number of dependents, outstanding loans, lifestyle expenses, and future goals like children’s education. Term insurance makes it easier to buy adequate coverage at an affordable cost.

9.Is employer-provided life insurance enough?

Employer-provided life insurance is usually not sufficient on its own. Most employer plans offer limited coverage, often equal to one or two years of salary. Additionally, coverage may end if you change jobs. Having an individual term insurance policy ensures continuous and adequate protection.

10.Are life insurance death benefits taxable in the USA?

In most cases, life insurance and term insurance death benefits are tax-free for beneficiaries in the United States. This makes insurance an effective tool for financial protection and estate planning. However, certain estate tax rules may apply for very large policies.

11.Can I have both life insurance and term insurance?

Yes, many people choose to have both. Term insurance is used for income protection during working years, while a small life insurance policy may be used for estate planning or final expenses. This combination allows flexibility while keeping overall costs under control.

12.What happens if I stop paying premiums on life insurance?

If you stop paying premiums on a life insurance policy, the policy may lapse or use accumulated cash value to keep coverage active for a limited time. The outcome depends on the policy type and terms. This is why life insurance requires long-term commitment and careful planning.

13.Is term insurance suitable for retirees?

Term insurance is usually less suitable for retirees because premiums increase significantly with age. Retirees may consider life insurance for estate planning or final expenses, depending on their financial situation and goals.

14.Which is better for young families: life insurance or term insurance?

For young families, term insurance is generally the better choice. It provides high coverage at a low cost, ensuring that children’s education, housing, and daily expenses are protected. Life insurance may not be necessary at this stage unless there are specific long-term planning needs.

15.How do I choose between life insurance and term insurance?

Choosing between life insurance and term insurance depends on your age, income, family responsibilities, and financial goals. If your primary goal is affordable protection, term insurance is the better

option. If your goal includes estate planning or lifelong coverage, life insurance may be considered.

Conclusion

Understanding life insurance vs term insurance is essential for building a strong and sustainable financial future in the United States. Term insurance provides affordable, effective protect

ion for most families, while life insurance serves specific long-term planning needs. Choosing the right policy at the right time ensures that your loved ones are protected, your finances remain stable, and your future goals stay intact.

Leave a Reply