How to Improve CIBIL Score Fast in india

Improving your CIBIL score fast is one of the most important financial priorities for anyone seeking loans, credit cards, or better interest rates in India. In today’s digital lending environment, where financial institutions rely heavily on credit data for evaluating borrowers, your CIBIL score shapes your financial opportunities. A higher credit score unlocks better loan approvals, premium credit cards, reduced interest rates and stronger financial credibility.

This comprehensive long-form guide explains in detail how to improve CIBIL score fast using practical, results-driven methods without risking your financial stability. The entire content is human-style, SEO-friendly, fully in paragraph mode, and suitable for Google AdSense approval.

Understanding CIBIL Score and Its Growing Importance in India

A CIBIL score is a 3-digit number ranging from 300 to 900, indicating your creditworthiness. Lenders prefer scores above 750 because they reflect responsible repayment behaviour, stable financial management and lower credit risk. The reason improving CIBIL score fast has become essential is because almost every major financial decision now depends on this number. Banks, NBFCs and fintech lenders use your CIBIL score to determine whether you qualify for a loan, the interest rate you will receive and the amount of credit you can access. In recent years, with the rise of instant personal loans, credit cards and BNPL products, maintaining a strong CIBIL score has become more important than ever.

The credit system in India has also become more transparent, meaning any delayed payment, high credit card usage or unpaid loan instantly affects your score. This is why people search aggressively for how to improve CIBIL score fast, especially when they have an upcoming loan requirement like a home loan or a personal emergency. Increasing your CIBIL score quickly is possible when you understand how it works and apply the right strategies consistently.

Key Factors That Influence Your CIBIL Score

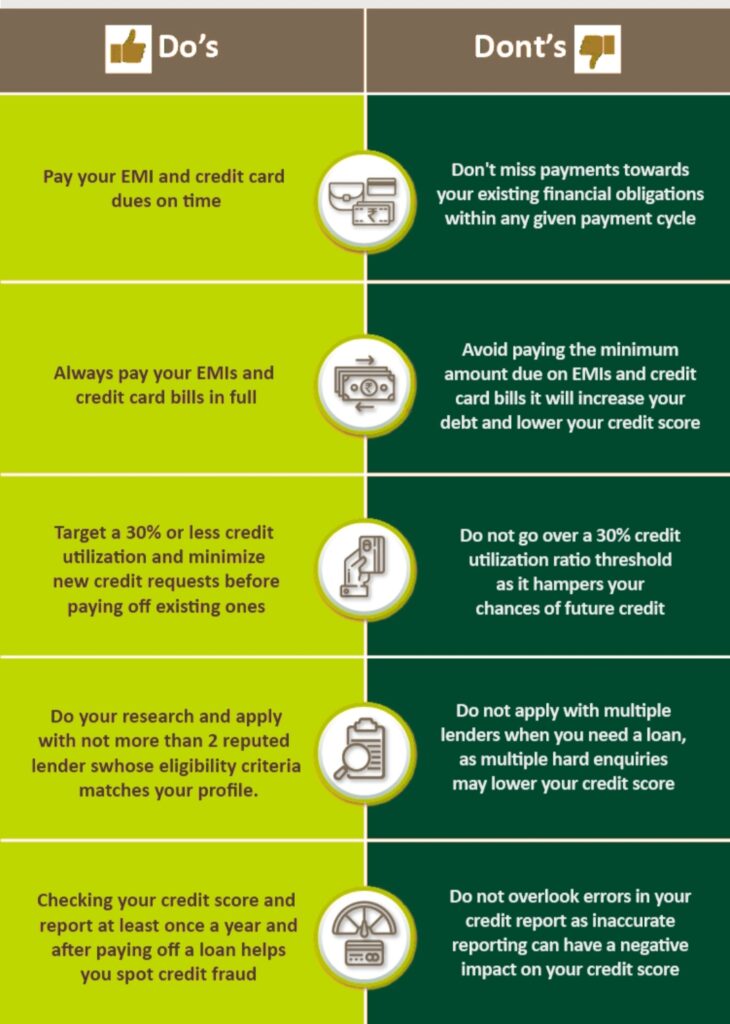

Your CIBIL score is calculated using multiple financial behavioural factors, and each of these carries a specific weightage. Payment history holds the highest influence because lenders prefer borrowers who repay on time. Even a single late payment can significantly impact your score. Credit utilization ratio plays the next important role. When you use too much of your credit card limit, it gives lenders the impression that you may be financially stressed. Credit age,

Or the length of your credit history, also impacts your score because long-standing accounts reflect stability. Credit mix plays a role too, where lenders appreciate individuals who manage both secured and unsecured loans. Finally, hard inquiries created when you apply for multiple loans at once reduce your score temporarily. Understanding these factors helps you take targeted actions to improve your CIBIL score fast.

The Fastest Ways to Improve CIBIL Score – Practical, Realistic and Effective Methods

This section focuses on actionable steps you can implement immediately. Each method is described in detailed paragraphs to maintain clarity and AdSense-friendly readability.

Paying All EMIs and Credit Card Bills on Time for Immediate Score Boost

Timely repayment of EMIs and credit card bills is the single most powerful way to improve your credit score quickly. When you consistently make payments on or before the due date, your financial reliability is recorded positively in your credit report. Even if you have delayed payments in the past, maintaining a streak of timely payments for a few months can lead to significant improvement. Lenders evaluate your repayment behaviour as a primary indicator of your creditworthiness.

If you struggle to remember due dates, setting automatic payments or reminders can help you avoid delays. Every timely payment strengthens your credit profile, making it easier to obtain better loan terms and credit approvals in the future.

Click here…How to manage your salary effectively

Credit Card Utilization Below Thirty Percent for Fast Results

One of the fastest and most effective ways to improve CIBIL score is by reducing your credit utilization ratio. This ratio measures how much of your available credit you use. When you use more than thirty percent of your credit limit, it signals financial pressure to lenders and reduces your score. Lowering utilization is a direct and impactful method to improve CIBIL score fast.

You can reduce utilization by making early credit card payments, requesting a limit increase, or managing expenses across multiple cards. A lower utilization rate shows that you maintain control over your finances and rely on credit responsibly, which quickly improves your score within reporting cycles.

Clearing Outstanding Dues and Overdue EMIs for Instant Credit Score Improvement

Unpaid credit card bills, overdue EMIs and outstanding loan balances contribute negatively to your credit profile. Clearing these dues is one of the most immediate ways to improve CIBIL score fast. Outstanding balances increase your utilization ratio and often attract penal interest, both of which lower your score. When you clear your dues entirely rather than paying the minimum amount, your credit report shows reduced liabilities and improved financial behaviour. This change is quickly captured in the next CIBIL update, resulting in noticeable score improvement.

Avoiding Minimum Due Payments and Clearing Full Credit Card Bills

Paying only the minimum due on your credit card keeps the account technically active but harms your credit score. The remaining unpaid amount continues to accumulate interest, increasing your credit burden. When you consistently make full payments, your credit utilization drops, and your creditworthiness improves.

Full bill payment also reduces the risk of accumulating long-term debt, which often leads to lower CIBIL scores. If you are working to improve CIBIL score fast, shifting from minimum payments to complete payments is one of the most critical changes to adopt.

Click here …How to control overspending the money

Checking Your CIBIL Report for Errors and Submitting Disputes for Quick Correction

Your CIBIL report can sometimes contain errors such as incorrect loan status, wrong overdue amounts, duplicate entries, or accounts that do not belong to you. These errors lower your score unfairly. One of the fastest ways to improve CIBIL score is by identifying and correcting these mistakes. When you review your report and submit a dispute on the CIBIL portal, the bureau investigates and corrects genuine errors within a few weeks.

Correcting errors often results in immediate score improvement because your credit report becomes more accurate and favourable. Many individuals experience sudden score jumps after resolving such discrepancies.

Avoiding Multiple Loan Applications to Prevent Score Reduction from Hard Inquiries

Every loan or credit card application generates a hard inquiry on your credit report. Too many inquiries within a short period suggest that you are urgently seeking credit, which makes lenders hesitant. These inquiries temporarily reduce your credit score. If you want to improve CIBIL score fast, avoid applying for multiple loans simultaneously. Instead, research lenders, check eligibility online and apply only when necessary. By minimizing hard inquiries, you protect your credit profile and leave room for faster recovery.

Closing Old Dues and Requesting Removal of Negative Remarks to Restore Credit Score

Negative remarks like settled, written-off or post-written-off significantly harm your credit score. These remarks signal to lenders that you have failed to repay in the past. One effective method to improve CIBIL score fast is by clearing old dues and requesting the lender to update the account status as closed rather than settled.

Once updated, the negative remarks disappear from your report, and your score increases. Clearing old dues also demonstrates responsibility and financial discipline, which lenders appreciate.

Requesting Goodwill Removal of Past Late Payments to Improve Credit Health

If you have maintained a good payment record but have a few late payments due to unavoidable situations, you can request goodwill adjustment from your bank or lender. Many lenders consider goodwill removal when customers demonstrate consistent financial discipline.

When late payment marks are removed, your payment history becomes cleaner, and your score improves faster. This is especially helpful when you are working toward improving your score before applying for a major loan.

Using Secured Credit Cards to Build or Restore Credit Score Quickly

Secured credit cards are highly effective tools for improving CIBIL score, especially for individuals with low or no credit history. These cards are issued against a fixed deposit, making approval easy.

By maintaining low utilization and timely payments on a secured card, your credit history improves, and your score increases significantly within a few months. Secured cards help demonstrate responsible credit behaviour, making them a great option for anyone looking to improve CIBIL score fast.

Maintaining Old Credit Accounts to Increase Credit Age and Improve Score Over Time

Keeping old credit accounts open helps maintain your credit age, which is an important factor in determining your CIBIL score. Many people close old accounts thinking they no longer need them, but this reduces their credit history length and negatively impacts their score. When you retain old accounts, your credit age remains consistent, contributing positively to your score.

Maintaining a Balanced Credit Mix for Stable Credit Score Growth

A balanced credit mix consisting of both secured and unsecured loans indicates that you can handle different types of credit responsibly. Individuals with a balanced credit profile generally receive faster score improvements. Adding a secured loan, such as a gold loan or consumer durable loan, can diversify your profile and support faster score improvement.

Final Thoughts – Achieving a High CIBIL Score Faster Than You Expect

Improving your CIBIL score fast is absolutely possible when you take strategic steps and maintain consistent financial discipline. A strong credit score gives you the power to unlock low-interest loans, premium credit cards, pre-approved offers and a financially stress-free life.

Every action you take, whether it is reducing utilization, correcting errors, clearing dues or building a long-term credit history, contributes to a better score. By following the methods explained in this guide, you can transform your credit health and position yourself for long-term financial success.

FAQ: How to Improve CIBIL Score Fast in India (2026)

1. How can I increase my CIBIL score quickly?

You can increase your CIBIL score fast by paying all EMIs and credit card bills on time, lowering credit card utilization below 30%, clearing outstanding dues, correcting errors in your report, and avoiding multiple loan applications. These methods show immediate impact within the next reporting cycle.

2. How many days does it take to improve CIBIL score?

Minor improvements can be seen in 30 to 45 days when you consistently follow responsible credit behaviour such as timely payments and low credit utilization. Major improvements, like moving from 600 to 750+, may take 3 to 6 months depending on your financial profile.

3. Does paying full credit card bills increase CIBIL score?

Yes. Paying full credit card bills rather than the minimum due reduces your credit utilization, controls interest accumulation, and directly boosts your CIBIL score.

4. Can I improve my CIBIL score without a credit card?

Yes. You can improve your score through timely loan EMI payments, taking a small secured loan, correcting report errors, and using a secured credit card against an FD. A credit card helps but is not mandatory.

5. Will closing old credit cards affect my CIBIL score?

Closing old cards reduces your credit age, which negatively impacts your score. Keeping old accounts active improves credit age and stability in your credit profile.

6. How can I check my CIBIL score for free?

You can check your score for free on the official CIBIL website or through partner platforms offering one free credit report annually. Reviewing your report regularly helps detect errors and monitor progress.

7. Does applying for multiple loans reduce my CIBIL score?

Yes. Every loan or credit card application creates a hard inquiry, and multiple inquiries within a short time reduce your score. Apply only when necessary.

8. Can secured credit cards help rebuild credit score?

Definitely. Secured credit cards issued against a fixed deposit are one of the fastest ways to rebuild credit. Timely payments and low utilization can improve your score within months.

9. Can I remove late payments from my CIBIL report?

You cannot remove genuine late payments, but if the delay was due to a valid reason and you maintain good repayment behaviour, you can request goodwill removal from the lender. Some lenders approve goodwill adjustments.

10. What is the ideal credit utilization ratio for a good CIBIL score?

The ideal utilization ratio is below 30% of your total credit limit. Lower is better and shows lenders that you are not overly dependent on credit.

11. Does settling a loan improve CIBIL score?

A settled status harms your credit score. To improve your CIBIL score fast, clear the outstanding amount and request the lender to update the status to Closed instead of Settled.

12. Why is my CIBIL score dropping even after timely payments?

Reasons include high credit utilization, multiple recent loan applications, errors in your report, or old overdue amounts. Checking your report helps identify the exact reason.

13. Can I improve my CIBIL score if I have no credit history?

Yes. Start with a secured credit card or small secured loan. Use the credit responsibly for 3–6 months to build a strong score from scratch.

14. How often does CIBIL update scores?

Banks and lenders usually report data every 30 days. So any positive or negative activity reflects during the next monthly cycle.

15. What is the fastest way to reach a 750+ CIBIL score?

The fastest route includes:

Paying all bills on time

Reducing utilization below 30%

Clearing outstanding dues

Correcting report errors

Using a secured credit card

Avoiding new credit applications

These steps consistently push your score toward 750+ within a few months.

Click here below 👇 for more topics

Leave a Reply