Credit Card vs Debit Card 2026 Detailed Comparison

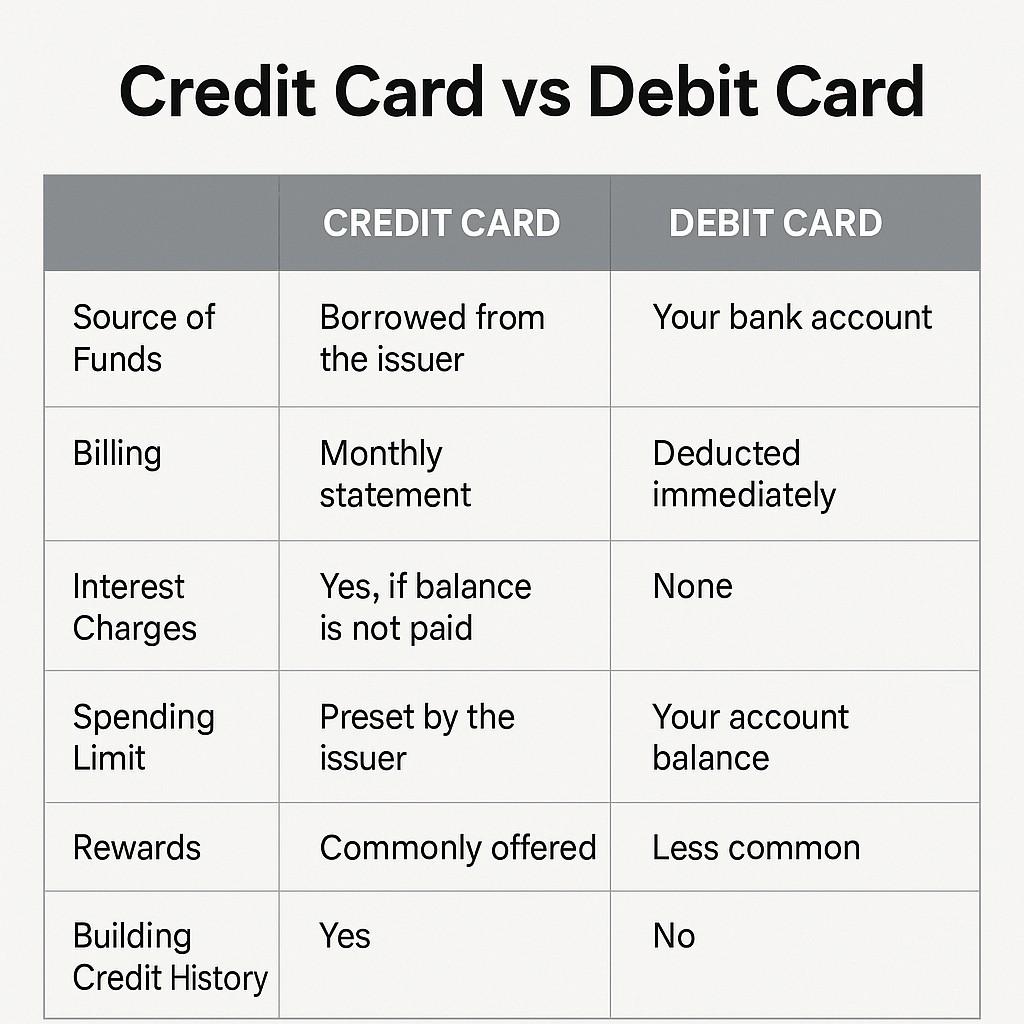

The comparison between Credit Card vs Debit Card generally appears simple from the outside because both cards are used for payments and both operate through the same card networks. However, the internal functioning, the flow of money, the financial impact, the liabilities involved, the charges applied, the security coverage, and the long-term implications differ significantly.

A credit card works on a credit-based mechanism where the cardholder uses the bank’s money for a defined billing period. A debit card works on a direct deduction model where the cardholder spends from the available bank balance. This operational difference establishes a clear boundary between the two products, creating separate usage characteristics and financial outcomes.

The Credit Card vs Debit Card distinction plays a crucial role in banking, personal finance, consumer spending, risk handling, and credit reporting. At the operational level, a credit card allows deferred payment, while a debit card executes instant payment.

This single structural difference shapes how users make purchases, build creditworthiness, and manage financial responsibilities. Understanding these distinctions is essential for selecting the correct payment instrument for online transactions, retail payments, recurring expenses, travel bookings, and high-value purchases.

For more details please check..https://www.visa.co.in/

Definition of a Credit Card

A credit card is a revolving credit facility provided by a bank or financial institution. The cardholder receives a predefined credit limit, and any transaction made using the card is treated as borrowed money.

The card issuer generates a bill at the end of each billing cycle, and the cardholder must make payment on or before the due date. When the full outstanding amount is paid, there is no interest charged. When the payment is delayed or partially paid, interest charges are applied as per the lender’s annualized interest rate.

In the formal comparison of Credit Card vs Debit Card , credit cards provide multiple additional features, including reward programs, cashback mechanisms, purchase protection, lounge access, EMI conversion, fuel surcharge waivers, and various category-based benefits.

Since the spending activity is reported to credit bureaus, credit cards become a part of a consumer’s credit profile. Timely repayment boosts credit scores, while late payments negatively impact creditworthiness.

For more topics click..👉 Income tax saving tips

Definition of a Debit Card

A debit card is a payment instrument directly linked to the cardholder’s bank account. Whenever a payment is made using a debit card, the amount is immediately deducted from the attached account balance. There is no concept of billing cycles, outstanding dues, interest charges, or minimum payments. The debit card is used purely to access the user’s existing funds.

Debit cards are commonly used for ATM withdrawals, online payments, POS transactions, and UPI-linked operations. Most banks issue debit cards by default when a savings account is opened. Annual fees, if applicable, are comparatively low. Debit cards do not influence credit scores because no credit is extended.

Operational Difference Between Credit Card vs Debit Card

In the Credit Card vs Debit Card comparison, the primary difference lies in the movement of funds. A credit card transaction shifts liability to the cardholder on a future date, while a debit card transaction finalizes the payment instantly. In credit card usage, the bank assumes initial financial responsibility, and the cardholder becomes responsible after the billing cycle closes. In debit card usage, the responsibility and payment occur simultaneously.

Credit card vs debit card,This creates different spending behaviors and risk levels. Credit card transactions provide short-term liquidity, allowing users to manage expenses without immediate cash outflow. Debit cards require available balance before purchase, making them suitable for controlled spending environments.

Financial Structure in Credit Cards

The financial structure behind a credit card involves multiple components:

In the formal comparison of Credit Card vs Debit Card,the credit limit is the maximum amount a cardholder can borrow during a billing cycle. Utilization of this limit affects credit score and determines repayment obligations. The billing cycle defines the period between bill generations. The due date represents the deadline for repayment.

The interest-free period is the number of days during which no interest is charged if the entire outstanding balance is settled on time. Credit cards also include minimum amount due requirements, late payment fees, interest charges, GST components, and cash advance fees.

This structure makes credit cards a sophisticated financial instrument requiring proper repayment discipline.

For more topics click..👉Smart money management tips

Financial Structure in Debit Cards

Debit cards follow a straightforward structure. They do not have billing cycles, outstanding dues, or minimum payment concepts. Funds are deducted directly, and the user cannot spend beyond available balance unless the bank has enabled overdraft. Costs associated with debit cards mostly include annual maintenance fees, ATM withdrawal limits, replacement charges, and foreign transaction fees.

The absence of revolving credit makes debit cards simpler, but also limits flexibility in financial management.

Benefits of Using a Credit Card

The advantages of credit cards include reward point accumulation, category-based cashback structures, purchase protection, extended warranty, travel privileges, lounge access availability, fuel benefits, EMI conversions, and the ability to make high-value purchases even with low immediate funds.

Additional advantages involve chargeback rights during fraudulent transactions, international acceptance, and the ability to track expenses easily through monthly statements.

Credit cards contribute positively to credit history when managed responsibly. A strong credit score enhances eligibility for mortgages, personal loans, vehicle loans, and other credit products.

Benefits of Using a Debit Card

Debit cards ensure controlled expenditure because the cardholder can spend only the available amount. There is no possibility of accumulating debt, and there are no interest charges.

Debit cards are widely accepted at ATMs, retail outlets, online merchants, and UPI-linked platforms. They are suitable for users who prefer cash-based budgeting, conservative spending, or limited financial risk exposure.

Debit cards are simple, require minimal maintenance, and eliminate the need for bill settlement processes.

Disadvantages of Credit Cards

Credit card disadvantages appear when repayment discipline is not maintained. High interest charges apply on unpaid balances, often among the highest in banking products. Late payment fees and penalty structures increase financial burden.

Excessive usage may lead to overspending, which affects credit utilization ratio and reduces credit score. Cash withdrawal using a credit card attracts significant fees and immediate interest without grace periods.

Improper use of credit cards may lead to financial stress and long-term debt accumulation.

Disadvantages of Debit Cards

Debit cards lack reward structures, cashback opportunities, and premium benefits that credit cards offer. Debit card fraud results in immediate deduction from the account, and refunds occur only after investigation. Debit card usage does not contribute to credit building, which disadvantages users seeking future credit facilities.

Debit cards also have lower international utility compared to credit cards due to risk restrictions imposed by banks.

EMI Availability in Credit Card vs Debit Card

Credit card vs debit card comparison,cards allow almost all high-value purchases to be converted into EMIs. The cardholder can choose tenure-based repayment with interest or no-cost EMI options offered by merchants. Debit cards offer EMI options in select banks, but such features are limited and require pre-approval. Credit card EMI structures are more advanced and widely accepted across online and offline merchants.

Security Levels in Credit Card vs Debit Card

In the formal comparison of Credit Card vs Debit Card ,cards offer advanced security advantages because transactions do not immediately affect the bank account. Fraudulent transactions can be disputed, and the amount is usually protected until resolution. Debit card fraud directly impacts the user’s bank balance, creating temporary financial loss until reversal. Banks apply stronger monitoring for credit cards because the risk lies initially with the bank.

Impact on Credit Score

In the formal comparison of Credit Card vs Debit Card,Credit cards influence the credit score because repayment activity is reported to credit bureaus. Timely repayments improve the score, while missed payments reduce it. Debit cards do not affect credit scores because they do not involve credit exposure.

For more topics click..👉How to improve CIBIL score fast

Usage Suitability

In the formal comparison of Credit Card vs Debit Card, Credit cards are suitable for users who want rewards, cashback, structured EMI options, and credit-building benefits. Debit cards are suitable for users who prefer direct expenditure control with no risk of debt creation. The suitability depends on individual financial habits, budgeting style, payment discipline, and long-term financial planning.

Conclusion of Credit Card vs Debit Card

In the formal comparison of Credit Card vs Debit Card, each instrument serves a different function. Credit cards provide flexibility, credit-building ability, and financial advantages when managed well. Debit cards provide direct spending control and eliminate the risk of debt. Selection should be based on financial discipline, spending patterns, and the requirement for rewards or credit growth.

For more topics click..👉How to control overspending money

FAQ

Q1: Which is safer, a credit card or a debit card?

Credit cards offer stronger fraud protection because money is not deducted immediately.

Q2: Which card is better for online shopping?

Credit cards are more advantageous due to rewards and protection features.

Q3: Does a debit card improve credit score?

No. Only credit cards affect credit reports.

Q4: Which card should beginners use?

Beginners who want controlled spending may prefer debit cards.

Q5: Can a credit card be used for EMI?

Yes. Most credit cards support EMI conversion for multiple categories.

Leave a Reply