Compound Interest: A Complete 2026 Guide to Growing Your Wealth Faster

Compound Interest is one of the most powerful financial concepts every individual should understand, especially in 2026 when people are searching for smarter and safer ways to grow their money. Whether you are a student, a working professional, a business owner or a retiree planning your future, the idea of Compound Interest can completely change the way you look at investing and saving.

It is a strategy that allows your money to grow on its own, quietly and steadily, without requiring constant effort. Many people think wealth comes only from high income or big business, but the reality is that long-term wealth is created through smart financial planning and the disciplined use of Compound Interest. It rewards patience, consistency and time, which are the three pillars of successful wealth building.

In simple terms, Compound Interest is the interest earned not just on the money you invested, but also on the interest that has been added over time.

This creates a powerful cycle where your money grows at an increasing speed every year. In a world where inflation keeps rising and living costs are increasing, using Compound Interest helps you stay financially secure and build a stronger future. When used correctly, Compound Interest becomes the foundation for financial independence, early retirement, long-term savings and wealth creation that lasts for generations.

Click to know full article about..Smart management tips

What Makes Compound Interest So Special in 2026

The year 2026 has brought major changes in the way people manage personal finance. More individuals are looking for safe and effective methods to grow their money. This is where Compound Interest becomes extremely important.

Unlike simple interest where returns remain constant, Compound Interest allows your savings to multiply faster over time. The longer you keep your money invested, the stronger the compounding effect becomes.

One of the biggest reasons Compound Interest works so well today is the increasing availability of investment tools that support compounding. Whether it is SIPs in mutual funds, fixed deposits, PPF accounts, recurring deposits or pension schemes, nearly every long-term investment option uses the principle of Compound Interest to grow your money. This means anyone, regardless of income level, can benefit from compounding by investing consistently and giving their money enough time to expand.

Many people think they need a large amount of money to start investing, but Compound Interest proves that even small investments can create big results when given enough time. Someone who invests ₹2,000 per month at a young age often ends up wealthier than someone who invests ₹10,000 per month later in life. This happens because the early investor allows Compound Interest to work for more years. Time is the real fuel that powers compounding.

Understanding Compound Interest in a Simple and Practical Way

The true strength of Compound Interest lies in how it gradually increases your wealth. It is like planting a tree. In the first few years, growth seems slow and unimpressive. But as the roots strengthen, the tree grows rapidly and becomes stronger each year. Similarly, Compound Interest starts slow but speeds up dramatically as the years pass. This is the reason financial experts always say, “Start early, stay invested, and let compounding take care of the rest.”

Click to know..Investopedia – Compound Interest Explanation

When you invest in a mutual fund SIP, the returns you earn get reinvested automatically. These reinvested returns start generating more returns, and over time your total wealth grows at a much faster pace. This pattern repeats again and again, leading to exponential growth.

Even fixed deposits follow this principle, where the interest is added to the principal repeatedly depending on the compounding frequency. In a PPF account, your balance grows every year with tax-free compounding, making it one of the most reliable long-term investments in India.

The real magic of Compound Interest lies in not interrupting the process. When you withdraw your investments too early, the compounding effect gets disturbed and the long-term benefits reduce significantly. People who stay committed to long-term investing often see the biggest results from compounding.

The Simple Explanation of the Compound Interest Formula

Although the Compound Interest formula looks mathematical, its meaning is straightforward. It explains how your money grows when interest keeps getting added to the principal amount. The formula shows that the more frequently your money compounds, the faster it grows.

But in practical life, you don’t need to calculate it manually because online calculators and financial apps can easily show the compounding results. What matters is not memorizing the formula but understanding how small investments grow into large amounts when left untouched for many years.

When you invest early and avoid unnecessary withdrawals, the formula works in your favor. It silently builds wealth in the background, even when you are not actively adding money. Compounding does not require financial expertise; it only needs commitment and patience. That is why beginners and experts alike rely on Compound Interest for wealth creation.

Real-Life Impact of Compound Interest: Early vs Late Investors

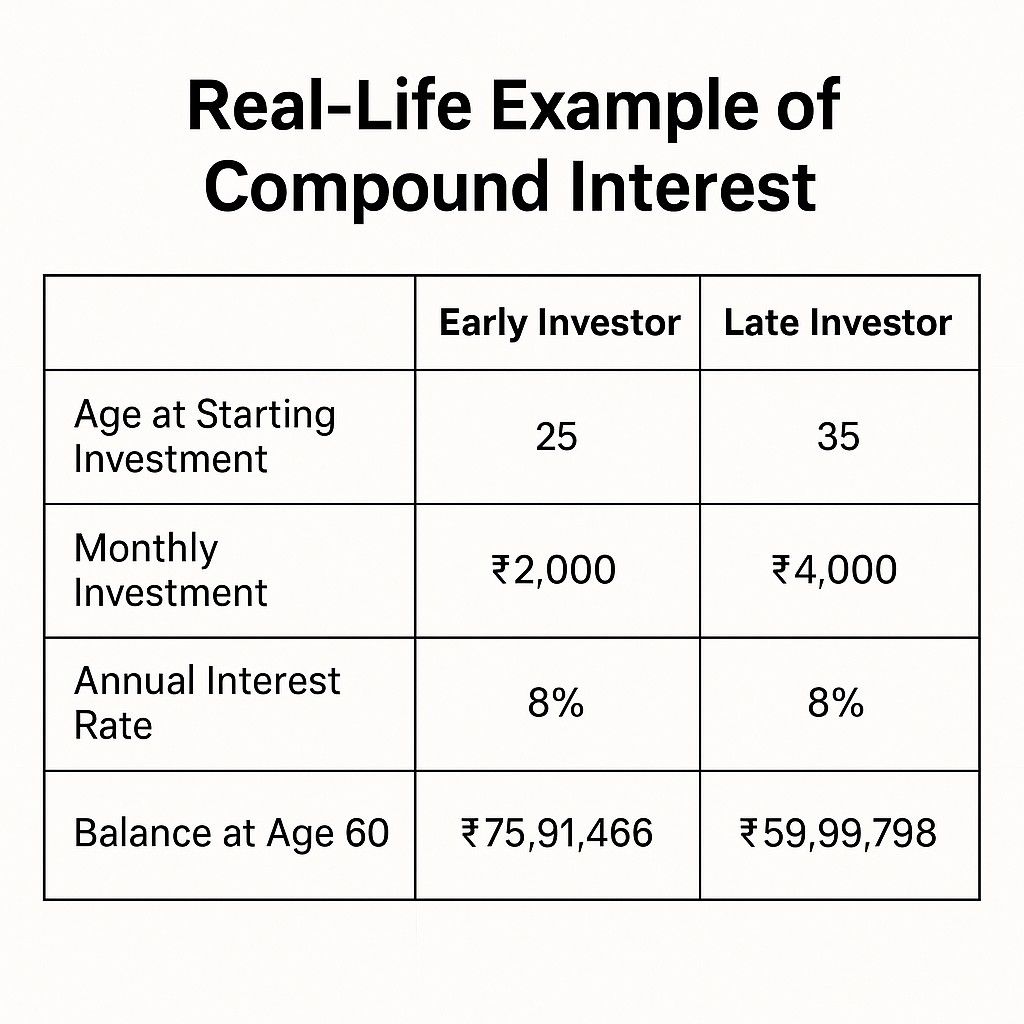

One of the best ways to understand the power of Compound Interest is by comparing two investors. Imagine one person starts investing at age 25 with a small amount every month, while another person starts at age 35 with a larger amount.

Even though the second investor contributes more, the first investor often ends up wealthier at retirement because they gave Compound Interest ten extra years to work. Those ten years make a massive difference because compounding becomes stronger with time.

This shows that the most valuable element in Compound Interest is not money but time. Starting early gives you a huge edge. Even small SIP amounts like ₹1,000 or ₹2,000 per month become meaningful when you stay invested for 20 or 30 years. On the other hand, delaying investments reduces the compounding advantage and makes it harder to catch up later.

This concept is also why retirement accounts grow so significantly. People who contribute consistently over many years often see their money multiply to a much larger amount than what they initially invested. This is the long-term reward of trusting the compounding process.

Best Investment Options That Benefit from Compound Interest in 2026

In 2026, there are several investment options that use Compound Interest to help your money grow. Mutual funds through SIPs remain among the most effective because they offer compounding benefits along with market growth. SIPs are flexible, easy to start and suitable for all income groups. They allow your investments to grow monthly, which enhances the compounding effect.

Fixed deposits are preferred by people who want stability and guaranteed returns. Although the returns may not be as high as market-linked investments, the compounding effect ensures that your money grows steadily. PPF accounts are another excellent option because they offer long-term compounding with tax-free returns, making them ideal for retirement planning. NPS combines market exposure with compounding growth, helping individuals build a strong retirement fund over the years.

Recurring deposits are popular among beginners because they promote disciplined monthly savings while offering compounding benefits.

Click to know full article about ..Income tax saving tips in india legally

All these options rely on the same principle: the longer your money stays invested, the more powerful the compounding becomes.

How to Make Compound Interest Work Best for You

To get the maximum benefit from Compound Interest, starting early is the most important step. The earlier you begin, the more years your money gets to grow. Even if the amount is small, it builds a strong financial foundation.

Increasing your investment gradually every year amplifies the compounding effect. Avoiding early withdrawals is crucial because once compounding is interrupted, your growth slows down.

Choosing investments that compound monthly or quarterly also helps your wealth grow faster. Automating your SIP payments ensures consistency, which is essential for long-term success. The biggest mistake people make is stopping their investments during market fluctuations.

But in reality, continuing SIPs during downturns often leads to better long-term results because you buy more units at lower prices, strengthening future compounding.

Click to know full article about ..What is SIP? A complete guid about SIP

Why Many People Fail to Benefit from Compound Interest

While Compound Interest is easy to understand, many people still fail to benefit from it because they underestimate its long-term power. Some treat investments like short-term commitments and expect quick results.

Others withdraw money for small expenses instead of keeping it invested for long-term goals. Some choose low-return savings accounts that don’t beat inflation, which reduces the real value of their money.

The truth is that Compound Interest requires patience and consistency. It rewards those who stay disciplined and think long-term. The biggest growth usually happens after many years, not in the beginning. People who understand this achieve financial independence earlier and with less stress.

Compound Interest and Inflation: How Compounding Protects Your Wealth

Inflation reduces the purchasing power of money every year. If your money is sitting idle or earning low interest, it loses value. But when you invest using Compound Interest, your wealth grows at a rate that can beat inflation.

This means your savings retain their value and even increase over time. Compounding acts like a shield that protects your financial future from rising costs.

Final Thoughts on Why You Should Start Using Compound Interest Today

Compound Interest is more than a financial formula; it is a strategy that can shape your future and give you long-term financial stability. In 2026, when people want smarter ways to grow their money without unnecessary risks, Compound Interest becomes the foundation of financial planning.

It works for everyone, regardless of income level, age or experience. Whether you are starting small or investing big, compounding rewards you as long as you stay consistent.

If you want financial freedom, a secure retirement and long-term wealth, the best time to start using Compound Interest is today. Every day you delay is a lost opportunity for compounding. Begin now, invest regularly and trust the long-term process. Over the years, you will be amazed at how silently and powerfully Compound Interest transforms your wealth.

Frequently Asked Questions (FAQ) About Compound Interest

What is Compound Interest and why is it important?

Compound Interest is the interest earned not only on the original amount you invest but also on the interest that gets added over time. This creates a powerful cycle where your money grows faster each year. It is important because it helps build long-term wealth without requiring high income or large investments. Even small amounts grow significantly when left to compound for many years. For anyone planning financial independence, retirement or long-term savings, Compound Interest is one of the most essential concepts to understand.

How does Compound Interest work in real life?

Compound Interest works by reinvesting the interest you earn, allowing it to generate additional returns. For example, when you invest in a SIP or PPF account, the interest or returns you receive automatically become part of your principal. This increased amount then earns more interest, which keeps repeating year after year. Over time, this creates exponential growth, meaning your money grows much faster in later years compared to the initial years.

Why do financial experts say to start investing early?

Experts recommend starting early because Compound Interest becomes stronger with time. The earlier you start, the more years your money gets to grow. Even a small amount invested in your 20s can grow more than a larger amount invested in your 30s or 40s. Time is the biggest factor in compounding, and starting early gives your money a chance to multiply many times over.

Can Compound Interest really make a person wealthy?

Yes, Compound Interest can make a person significantly wealthy when used with patience and consistency. You do not need high income to benefit from compounding. Even small monthly investments, when continued over many years, can turn into large amounts. Most people who retire comfortably or achieve financial freedom did so by consistently investing and allowing Compound Interest to work for decades.

What are the best investments that use Compound Interest?

The best investments that benefit from Compound Interest include SIPs in mutual funds, Public Provident Fund (PPF), National Pension System (NPS), fixed deposits, recurring deposits and long-term retirement plans. Each of these options grows your money using compounding. SIPs offer monthly compounding based on market performance, while instruments like PPF and FDs provide a stable compounding environment. The choice depends on whether you prefer growth, stability or tax benefits.

How long should I stay invested to benefit from Compound Interest?

To benefit fully from Compound Interest, you should stay invested for as long as possible. The magic of compounding becomes more powerful after several years. While you may see moderate returns in the first few years, the real growth happens after ten, fifteen or even twenty years. The longer you remain invested, the more exponential your returns become.

How much money should I invest to get good results from Compound Interest?

There is no fixed amount required to benefit from Compound Interest. You can start with any amount that fits your budget. What matters more than the amount is consistency. Investing regularly every month and increasing your contributions over time gives you the best results. Even small investments create meaningful growth when left to compound for many years.

What happens if I stop investing or withdraw early?

Stopping your investments or withdrawing early slows down or completely disrupts the compounding process. When you take money out, the principal becomes smaller, reducing future growth. Many people miss out on large long-term gains because they withdraw their money for short-term needs. To benefit fully from Compound Interest, it is best to stay invested and avoid unnecessary withdrawals.

Can Compound Interest help beat inflation?

Yes, Compound Interest helps your investments grow at a rate higher than inflation when used correctly. Inflation reduces the value of money over time, meaning your savings lose purchasing power. But investments that use Compound Interest, such as SIPs and PPF, help your money grow faster than inflation, protecting your wealth in the long run.

Is Compound Interest suitable for beginners?

Compound Interest is perfect for beginners because it does not require complex financial knowledge. Anyone can start with small amounts and grow their wealth gradually. It is one of the most beginner-friendly ways to create long-term financial stability. With simple tools like SIPs, FDs and PPF, even new investors can benefit from compounding without taking high risks.

Leave a Reply