How to Build Credit Score in USA From Scratch 2026 Beginner Guide

If you’re trying to understand how to build credit score in USA from scratch, you’re not alone. Every year, millions of people—including students, immigrants, and young adults—start their financial journey with zero credit history. And if you’re new to the United States, it can feel stressful when everything seems to require a credit score: renting an apartment, buying a car, getting a phone plan, and sometimes even certain jobs.

That’s why learning how to build credit score in USA from scratch is one of the most important steps you can take for your financial future. The good news? You don’t need thousands of dollars, you don’t need a long history, and you certainly don’t need complicated financial knowledge. You just need the right plan and consistent habits.

This guide is designed to walk you through the entire process in a simple, friendly, and supportive way—just like a personal finance blogger who has already been through this experience and wants to help you succeed.

This guide is designed to walk you through the entire process in a simple, friendly, and supportive way—just like a personal finance blogger who has already been through this experience and wants to help you succeed.

“To understand your rights as a borrower, you can review the official U.S. credit education guidelines provided by the Consumer Financial Protection Bureau.”

What Exactly Is a Credit Score in the USA?

Before you learn how to build credit score in USA from scratch, it helps to understand what a credit score actually is. In simple terms, it’s a number—between 300 and 850—that shows how trustworthy you are with borrowed money. In the U.S., lenders, landlords, insurance companies, and banks rely heavily on it.

A good credit score makes life easier.

A bad credit score makes everything expensive.

And no credit score means companies simply don’t know whether to trust you yet.

The most commonly used score is the FICO Score, and here’s how it generally works:

300–579 → Poor

580–669 → Fair

670–739 → Good

740–799 → Very Good

800–850 → Excellent

You don’t need to aim for perfect. Your goal for now is simple:

Get your first credit score and start building solid habits.

Full article about..

Best High-Yield Savings Accounts in USA: Highest APY Rates, Top Banks & Features

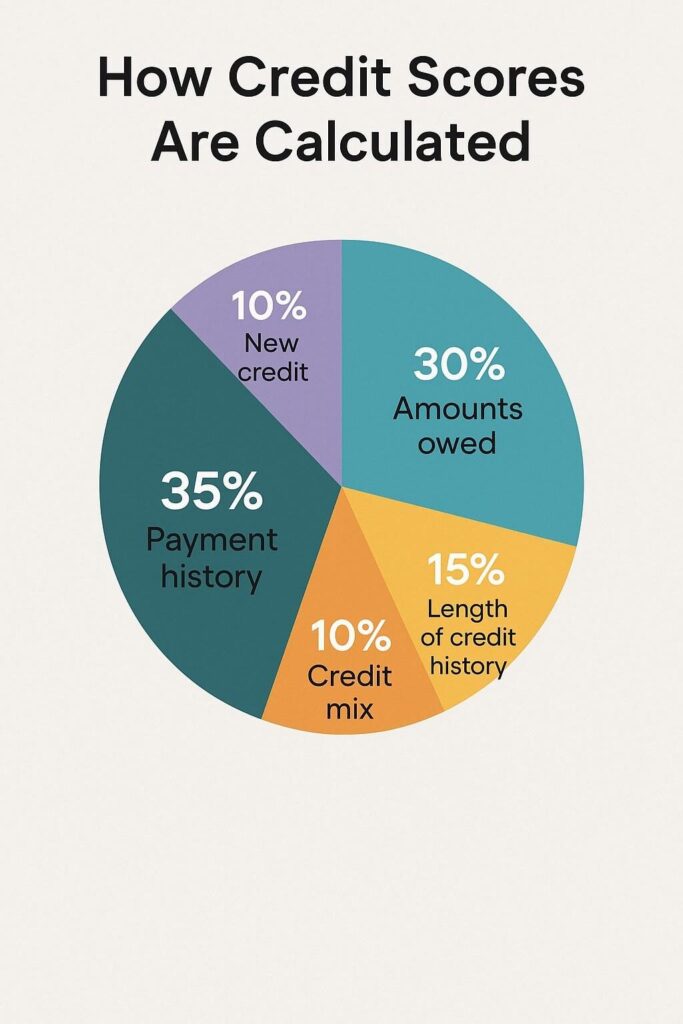

How Credit Scores Are Calculated

Understanding how a score is calculated will help you build credit faster and avoid the common mistakes most beginners make.

1. Payment History – 35%

This is the biggest part of your score. Pay on time every month, even if it’s the minimum payment. One late payment can hurt your score for months.

2. Credit Utilization – 30%

Credit utilization shows how much of your available credit you’re using.

Example:

If your limit is $500, try to keep your usage under $150.

Lower utilization = healthier score.

3. Length of Credit History – 15%

The longer you’ve had your accounts open, the better. This is why starting today is so important the earlier you begin, the stronger your long-term score.

4. New Credit – 10%

Applying for many credit cards in a short time leads to multiple “hard inquiries,” which can temporarily drop your score.

5. Credit Mix – 10%

Having different types of credit (like a credit card + loan) is good, but not required for beginners. Start simple.

“You can get your free annual credit reports through the U.S. government’s official website- https://usa.gov/credit-reports”

How to Build Credit Score in USA From Scratch – Step-by-Step Guide

This section explains the exact steps you need to take to start building credit in a safe, consistent, beginner-friendly way. Even if you have no financial background, following these steps will help you build your score from zero.

Step 1: Get a Beginner-Friendly Credit Card

If you’re starting with no history, don’t worry—there are several credit cards made specifically for beginners. These cards allow you to create your first credit line in a low-risk way.

Let’s break down the best beginner options:

Secured Credit Cards

A secured credit card is hands-down the easiest way for a beginner to build credit score in USA from scratch. You pay a refundable deposit—usually $200 to $500—and that becomes your credit limit.

Banks create secured cards for people exactly like you: those with no history, limited history, or rebuilding credit.

Best secured cards include:

Discover it® Secured Card

Capital One Secured Mastercard

Citi Secured Mastercard

Why secured cards work so well:

Easy approval

Report to all three credit bureaus

Helps create payment history quickly

Deposits are refunded when upgraded

Ideal for first-time users

If you want a safe, clean starting point, a secured credit card is your best friend.

Student Credit Cards

If you’re a student in the U.S., banks offer special credit cards that don’t require prior history.

These include:

Discover it® Student Cash Back

Chase Freedom Student

Bank of America® Student Card

Student cards offer cashback, no annual fees, and easy approval—perfect for building your score while studying.

No-Credit-Check Cards (Modern Approval)

Some companies approve you based on your income—not your credit score. These cards are great for new immigrants or those working part-time.

Examples:

Petal® 1

Petal® 2

Tomo Card

These cards help you build credit score in USA from scratch without needing prior credit history.

Full Article below here… 👇

Best Credit Cards in USA 2026: Top Rewards, Cashback, Travel & Low APR Cards

Step 2: Pay Every Bill On Time

Nothing builds your credit faster than consistent on-time payments.

Nothing destroys it faster than missing payments.

To stay safe:

Enable auto-pay

Pay early

Set phone reminders

Track due dates through your bank app

You don’t need to spend a lot. You just need to show that you are responsible.

Step 3: Keep Your Credit Utilization Low

This step matters more than beginners realize.

To build credit score in USA from scratch, you must keep your usage under:

30% of your credit limit.

Example:

If you have a $300 limit, stay under $90.

If you have a $500 limit, stay under $150.

Lower utilization = stronger score

Higher utilization = weak score, even if you pay on time

A great habit is:

👉 Swipe the card for small expenses

👉 Pay multiple times each month

👉 Keep balances low

This shows lenders you are responsible with borrowed money.

Step 4: Start With Small Purchases You Can Easily Pay Off

Many beginners think they need to spend a lot to build credit.

You don’t.

Building credit score in USA from scratch is NOT about high spending—

It’s about consistent spending + consistent repayment.

Start with simple purchases like:

Groceries

Netflix or Spotify subscription

Gas

Phone bill

Pay the balance in full every month.

Credit bureaus care about reliability, not the size of your purchases.

Step 5: Become an Authorized User on a Trusted Person’s Card

This method can boost your credit faster than anything else.

If a family member or spouse has a good credit score, they can add you as an authorized user on their credit card.

Benefits include:

Their good history helps your score

No credit check needed

You don’t have to use the card

Zero stress, zero risk

This is one of the fastest ways to build credit score in USA from scratch—sometimes within 30–60 days.

Step 6: Use a Credit Builder Loan

Credit builder loans are designed for people with zero credit history. You essentially “save” money each month while building credit.

Companies like:

Self

Kikoff

Credit unions

offer small monthly plans like:

$15/month → Positive credit reporting

$25/month → Build history safely

At the end of the loan, you get your money back.

It’s one of the safest tools for beginners.

Step 7: Don’t Apply For Too Many Credit Cards

When you apply for a card, lenders perform a hard inquiry, which can temporarily lower your score.

To build your credit score safely:

Start with 1 beginner card

Wait 6 months

Add another if necessary

Slow, steady growth is always better than rushing

and collecting inquiries.

Step 8: Monitor Your Score Regularly

Tracking your score helps you catch mistakes, understand changes, and stay consistent.

You can check your score for free on:

Credit Karma

Discover Scorecard

Bank apps

Monitoring keeps you aware and motivated.

How Long Does It Take to Build Credit Score in USA From Scratch?

One of the first questions beginners ask is:

“How long will it take before I actually see my credit score?”

The truth is, the timeline varies from person to person, but most people follow a similar pattern. Here’s a realistic breakdown based on thousands of beginner experiences:

✔ After 1 Month

Your credit card activity starts getting reported to the credit bureaus. You won’t have an official credit score yet, but your history begins forming.

✔ After 3 Months

Most beginners see their first official credit score appear. It might be in the 600s or slightly lower depending on your usage, but this is completely normal.

✔ After 6 Months

Your score becomes more stable. If you’re following good habits—on-time payments and low utilization—you can easily reach the 650–700 range.

✔ After 12 Months

Many beginners reach the 700+ range, which lenders consider a strong score. At this point, you may qualify for better cards, higher limits, or lower interest rates.

✔ After 18–24 Months

With consistent habits, you can reach a very good score (730–760). This opens up premium benefits, travel cards, and lower loan rates.

Credit building is a journey—not a race. And the good news is that your first 12 months matter the most. Everything else builds on that foundation.

Full article about..

Best Checking Accounts for Beginners in USA 2025 Guide to Easy Banking

Common Mistakes Beginners Make When Trying to Build Credit Score in USA From Scratch

No beginner is perfect, so don’t worry if you make mistakes. But avoiding the biggest traps can dramatically speed up your progress.

Let’s go through the most common mistakes so you don’t fall into them:

Mistake 1 — Paying Late or Missing Payments

Even one missed payment can hurt your score for months. Beginners often forget deadlines because they’re learning the system.

Solution:

Enable automatic payments. It takes 10 seconds and removes almost all risk.

Mistake 2 — Using Too Much of Your Credit Limit

Beginner cards often come with small limits ($200–$500). Many people accidentally use most of their limit, pushing their utilization above 30%.

Solution:

Make multiple payments during the month or keep expenses small.

Full article about..

How to Control Overspending: Best Practical Ways to Stop Spending Money & Save More

Mistake 3 — Closing Old Cards Too Early

Your credit history length impacts your score. Closing your oldest card resets the “clock.”

Solution:

Keep your oldest card open, even if you rarely use it.

Mistake 4 — Applying for Too Many Cards at Once

Every application creates a hard inquiry. Too many inquiries signal risk to lenders.

Solution:

Start with ONE card. Add another after 6–12 months.

Mistake 5 — Believing Credit Building Requires High Spending

Building credit does NOT require using large amounts of money. You can build a great score with small monthly purchases.

Solution:

Use your card for simple recurring payments like Netflix, Spotify, groceries, or gas.

Mistake 6 — Ignoring Credit Reports

Errors happen more often than you think, especially for beginners.

Solution:

Check your reports every few months for mistakes or fraudulent activity.

FAQ — How to Build Credit Score in USA From Scratch

1. Can I build a credit score in USA without an SSN?

Yes. Some banks accept ITIN numbers instead of SSN, especially for secured cards and certain modern lenders.

2. How fast can a beginner reach a 700 credit score?

With consistent on-time payments and low utilization, many beginners reach the 700 range in 12 months.

3. What’s the easiest credit card to get with no history?

Discover it® Secured, Petal 1, and Capital One Secured are some of the easiest for beginners.

4. Does paying rent help my credit score?

Yes—if you use a rent reporting service that sends your payments to credit bureaus.

5. Can immigrants build credit score in USA quickly?

Absolutely. Many newcomers reach strong scores within a year using the steps in this guide.

6. Is it bad to have multiple credit cards?

For beginners, yes. Start with one card. Once you build a foundation, you can safely add more.

7. Does checking my credit score hurt my score?

No. Checking your own score is considered a soft inquiry.

8. Does credit utilization reset every month?

Yes. Keeping your balance low before the statement closing date helps a lot.

9. What happens if I close my first credit card?

You lose your longest credit history, which can drop your score.

10. How much should I spend monthly to build credit?

$20–$100 is enough. Small, consistent purchases are more effective than large ones.

Final Conclusion — Your Credit Journey Starts Today

Learning how to build credit score in USA from scratch can feel overwhelming at first, but it becomes simple once you understand how the system works. Your credit score is built on habits—small, smart decisions repeated over time.

If you:

pay on time,

use your card responsibly,

keep balances low,

avoid unnecessary hard inquiries,

and stay consistent…

You will build a strong, healthy credit score that opens financial doors for the rest of your life.

Whether you’re a student, a new immigrant, or someone restarting your financial journey, you have everything you need to succeed. Your credit score doesn’t define you—but it can help shape a more secure and opportunity-filled future.

Start today, stay patient, and watch your score grow month after month.

Leave a Reply