Digital Savings Account in 2026: Features, Benefits, Charges, and Complete Online Opening Guide

A Digital Savings Account in 2026 has become one of the most preferred banking products among Indian customers because of its convenience, instant onboarding, zero paperwork, and modern security features. The traditional experience of visiting a branch, filling out physical forms, waiting for approval, and then activating an account has been replaced by an entirely digital journey.

In 2026, customers can open a savings account from home in just a few minutes using Aadhaar, PAN, mobile number, and video KYC. This blog explains every detail about Digital Savings Account in 2026, including the features, benefits, charges, eligibility, documents required, step-by-step online process, comparisons with normal accounts, best options from top banks, neobanks, common FAQs, and important things you must know before opening one.

What Is a Digital Savings Account in 2026?

A Digital Savings Account in 2026 is a fully online bank account that allows users to complete the account opening process without visiting a physical branch. It is created through digital KYC methods such as Aadhaar authentication and video verification, making it extremely fast and convenient. Unlike earlier years when partial KYC used to restrict account limits, banks in 2026 have upgraded their systems to allow full KYC through video verification, enabling customers to enjoy the same features and limits as a normal savings account.

These accounts come with instant virtual debit cards, UPI activation, mobile banking access, and advanced security powered by AI-driven fraud detection systems. Because of increased smartphone usage, improved network connectivity, and the growth of digital payments, Digital Savings Account in 2026 has become a mainstream choice for students, employees, freelancers, homemakers, and even senior citizens.

Click to know Full article about..20 Best Side income ideas

Key Features of a Digital Savings Account in 2026

The features of a Digital Savings Account in 2026 are designed to provide speed, flexibility, security, and complete control through a mobile-first experience. The first major feature is the 100% online onboarding, which eliminates the need to physically interact with bank staff or submit printed documents. The entire process, from application to activation, is completed in minutes.

Another important feature is Aadhaar-based authentication, which allows instant verification using an OTP sent to the customer’s Aadhaar-linked mobile number. One of the most notable advancements is video KYC, where a bank officer verifies the applicant’s identity through a live video call, checking the face, PAN card, and Aadhaar card. This method replaced the earlier need for in-person verification and has become a standard across all major banks.

Another key feature of Digital Savings Account in 2026 is the availability of zero-balance options. Many banks are RBI registered, including Kotak 811, ICICI Insta Save, Axis ASAP, and neobanks, offer accounts with no minimum balance requirement. This makes digital accounts ideal for beginners and users wanting financial flexibility. Digital savings accounts also provide instant virtual debit cards, which can be used for online shopping, UPI linking, subscriptions, and payments immediately after the account is activated. Customers can request a physical debit card later if needed.

Additionally, digital accounts offer higher interest rates in some cases, especially from neobanks and payment banks. These accounts are integrated with UPI, mobile banking, internet banking, automatic bill payments, and financial planning tools.

Security is a major highlight of Digital Savings Account in 2026. Banks use biometric authentication, real-time fraud monitoring, device binding, and encrypted communication to ensure safe transactions. This advanced security gives users confidence while performing digital transactions, especially UPI, which has grown exponentially across India.

Click to know full article about..How to control overspending the money

Benefits of a Digital Savings Account in 2026

The benefits of Digital Savings Account in 2026 are extensive, making it significantly more attractive than conventional savings accounts. The biggest advantage is convenience. Customers no longer need to travel to a branch, stand in queues, or handle paperwork. Everything happens from their smartphone within a few minutes. This ease of use is especially valuable for busy professionals, working parents, and individuals living in remote areas.

Another benefit is the potential for higher interest rates. Some digital banks and neobanks offer competitive interest rates to attract online customers. Digital Savings Account in 2026 also offers flexibility through zero-balance features, allowing customers to maintain the account even with no funds. Digital accounts also provide instant activation of UPI services, enabling users to start sending and receiving money immediately. Digital platforms also make it easier to track expenses, view statements, and manage personal finances through app-based dashboards.

Lower charges are another advantage. Many digital savings accounts waive fees for SMS alerts, maintenance, and online transfers. Since digital accounts reduce operational costs for banks, these savings are often passed on to customers. Additionally, the eco-friendly, paperless process helps reduce environmental waste, making it a sustainable choice.

Click to know full article about..How to manage your salary effectively

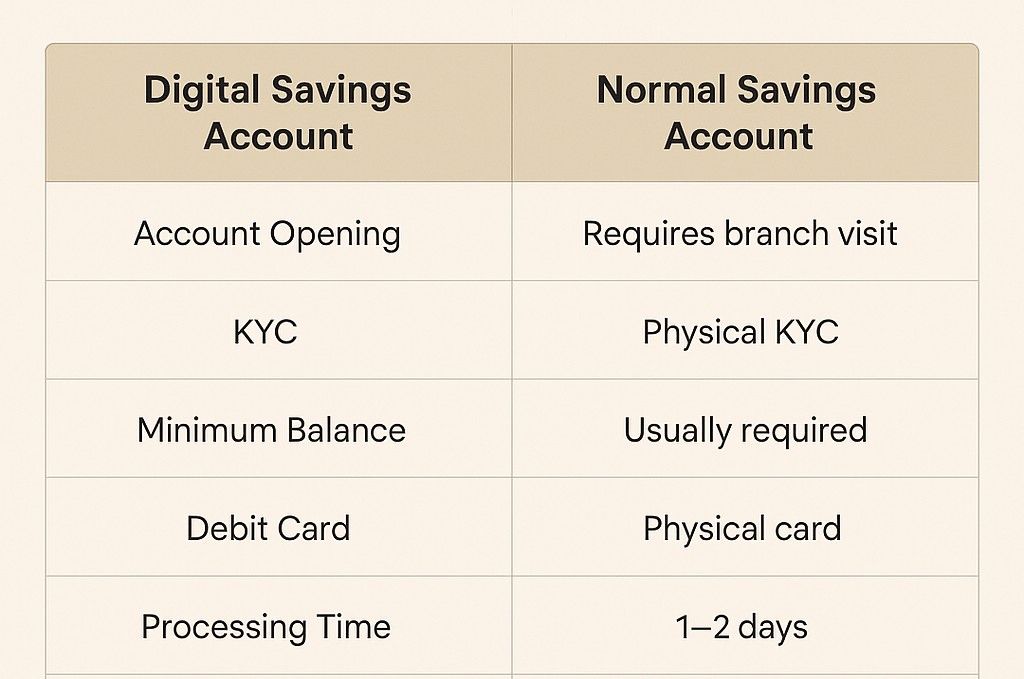

Digital Savings Account vs Normal Savings Account in 2026

A Digital Savings Account in 2026 and a normal savings account both serve the purpose of saving money, but the user experience differs significantly. Digital accounts are opened online without visiting a branch, while normal accounts require physical documentation and in-person verification. Video KYC replaces manual verification, making digital account opening faster and more efficient. Digital accounts are more flexible because most of them allow zero balance, whereas traditional accounts often require maintaining a minimum monthly balance.

While normal savings accounts are ideal for customers who prefer face-to-face support, digital savings accounts are designed for users who want quick, easy, and mobile-based banking. Digital Savings Account in 2026 also offers instant virtual debit cards, which normal accounts usually do not.

Overall, digital accounts are more suitable for younger users and tech-savvy customers, while traditional accounts still appeal to some individuals due to familiarity and in-branch services.

Click to know full article about..Income tax saving tips legally

Best Digital Savings Accounts in India (2026)

There are several excellent options for opening a Digital Savings Account in 2026 in India. HDFC Bank offers one of the most secure and user-friendly digital savings accounts, supported by strong backend systems and high reliability. ICICI Bank’s Insta Save account is another top choice, known for its instant onboarding, mobile app quality, and UPI readiness. Kotak 811 continues to be a leader in the digital banking space by offering zero-balance features, virtual cards, and attractive interest rates. SBI’s YONO-based digital savings account is popular among customers who want a trusted banking brand with secure systems. AxisBank’s ASAP digital account offers quick onboarding and smooth integration with UPI and bill payments.

These banks have optimized their digital platforms to ensure fast onboarding, safe transactions, and minimal user friction, making Digital Savings Account in 2026 extremely efficient compared to older banking methods.

Best Neobanks Offering Digital Savings Accounts in 2026

Neobanks are another major reason for the popularity of Digital Savings Account in 2026. These mobile-only banks offer advanced financial tools, categorized spending analysis, rewards, and higher interest rates. Fi Money and Jupiter are among the most popular neobanks in India, known for their user-friendly apps, budgeting features, and seamless UPI integration.

Niyo Global offers attractive benefits for international travelers, including low forex charges. Airtel Payments Bank and Paytm Payments Bank focus on digital-first banking with instant onboarding and easy-to-use apps.

Neobanks provide an enhanced digital experience compared to traditional banks, making them ideal for customers who want modern features, instant support, and smart money management tools.

Charges Applicable on Digital Savings Accounts in 2026

Although Digital Savings Account in 2026 is cost-effective, some charges do apply depending on the bank. SMS alert fees may apply, although many banks provide them free for digital accounts. ATM withdrawals usually come with a limited number of free transactions each month, after which banks charge nominal fees.

Issuance of physical debit cards, replacement cards, and checkbooks may involve additional charges. Online transfers such as UPI, NEFT, IMPS, and RTGS are typically free on digital channels. Due to reduced operational costs, digital accounts generally have lower fees compared to normal accounts.

Click to know full article about..Credit card vs debit card comparison

Eligibility Criteria for Opening a Digital Savings Account in 2026

Anyone who is 18 years or older and an Indian resident can open a Digital Savings Account in 2026. The applicant must have an Aadhaar card, a PAN card, and a mobile number linked with Aadhaar. Since the onboarding is online, the applicant must have a stable internet connection and a smartphone capable of handling video KYC.

Documents Required for a Digital Savings Account in 2026

The documentation for Digital Savings Account in 2026 is minimal. Aadhaar and PAN are the primary documents required. The applicant may also need to upload a clear photograph and provide a live signature during the video KYC verification.

How to Open a Digital Savings Account in 2026: Step-by-Step Guide

Opening a Digital Savings Account in 2026 is simple and straightforward. The first step is to download the bank’s mobile application or visit the official website of the chosen bank. After launching the application, the user needs to enter personal information such as name, mobile number, and email ID. The next step involves Aadhaar verification, where an OTP is sent to the Aadhaar-linked mobile number. Once Aadhaar and PAN details are authenticated, the user proceeds to complete the video KYC process.

During the video KYC, a bank officer verifies the applicant’s facial features, Aadhaar, PAN, and sometimes a live signature. Upon successful verification, the Digital Savings Account in 2026 is activated instantly. The user can then log in to the mobile app, view the virtual debit card, activate UPI, and start using all banking features.

Click to know full article about..How to Build an Emergency Fund quickly

Security Features of Digital Savings Accounts in 2026

Security plays a vital role in the success of Digital Savings Account in 2026. Banks and neobanks have adopted strong security measures including biometric login, two-factor authentication, AI-based fraud monitoring, device binding, and encrypted data transmission. Real-time transaction alerts help users track any suspicious activities immediately. These security enhancements make digital banking extremely reliable and trustworthy.

Full article about ..How to Improve CIBIL score fast

Conclusion

The rise of the Digital Savings Account in 2026 marks a major shift in the way Indians manage their money. With faster onboarding, seamless video KYC, zero-balance flexibility, enhanced mobile features, and top-tier security, digital savings accounts have become a smarter and more convenient alternative to traditional banking. They offer everything a modern user needs—instant access, simplified transactions, higher transparency, and complete control through mobile apps.

While normal savings accounts still serve customers who prefer in-branch support, digital savings accounts clearly outperform in terms of accessibility, speed, and ease of use. As more banks and neobanks continue to innovate, digital banking will only become more powerful, intuitive, and user-centric.

Whether you are a student, working professional, freelancer, or first-time account holder, choosing a Digital Savings Account in 2025 can help you enjoy a smooth, secure, and fully digital banking experience from day one.

In the end, the right choice depends on your personal preference—but for most modern users, a Digital Savings Account in 2026 provides the perfect balance of convenience, security, and financial freedom.

Frequently Asked Questions (FAQ)

1. Is a Digital Savings Account in 2026 safe?

Yes, it is completely safe because banks use encryption, biometric login, fraud detection, and secure servers.

2. Can I keep zero balance in my digital savings account?

Many banks allow zero balance, but some may require minimum maintenance depending on the account type.

3. Do digital accounts offer physical debit cards?

Yes, most banks provide optional physical debit cards upon request.

4. How long does video KYC take?

Usually 3 to 5 minutes, depending on network speed and verification quality.

5. Can I open multiple digital savings accounts?

Yes, you can open accounts with multiple banks, provided you meet their eligibility criteria.

Leave a Reply