What is SIP? Ultimate Beginner’s Guide to Systematic Investment Plan in India (2026 Updated)

What is SIP,In today’s modern financial world, saving money alone is no longer enough to achieve financial security or long-term prosperity. With rising inflation, rapidly increasing living costs, expensive education, growing medical expenses, and economic uncertainty, building wealth has become a crucial responsibility for everyone. Many people assume investing requires a large lump sum or deep financial knowledge, but the truth is completely different. Through SIP (Systematic Investment Plan), anyone can start investing with small monthly contributions and gradually build wealth with discipline and consistency. SIP has become one of the most trusted and widely used methods of investing in India, especially among beginners who are taking their first step towards financial independence.

For many years, people were afraid of investing in the stock market because they felt it was risky and complicated. They believed investing was only for wealthy individuals or financial experts. However, SIP has transformed this mindset by offering a simple, systematic, and affordable way to invest in mutual funds. Instead of trying to predict market ups and downs or waiting for the right time, SIP encourages continuous investment over time, which reduces risk and maximizes growth potential. Whether your goal is buying your first home, planning for children’s education, building a retirement fund, preparing for emergencies, or simply achieving financial freedom, SIP is a smart and reliable tool to achieve those goals.

For many years, people were afraid of investing in the stock market because they felt it was risky and complicated. They believed investing was only for wealthy individuals or financial experts. However, SIP has transformed this mindset by offering a simple, systematic, and affordable way to invest in mutual funds. Instead of trying to predict market ups and downs or waiting for the right time, SIP encourages continuous investment over time, which reduces risk and maximizes growth potential. Whether your goal is buying your first home, planning for children’s education, building a retirement fund, preparing for emergencies, or simply achieving financial freedom, SIP is a smart and reliable tool to achieve those goals.

This complete beginner’s guide explains everything you need to know about SIP, including what SIP is, how it works, its benefits, types of SIP, types of mutual funds suitable for SIP, returns calculation examples, best strategies, mistakes to avoid, myths, a comparison between SIP and lump sum investments, and a detailed step-by-step guide on how to start SIP in India. By the end of this article, you will gain clarity and confidence to begin your investing journey responsibly and successfully.

What is SIP in Mutual Funds?

SIP, or Systematic Investment Plan, is a method of investing regularly in mutual funds by contributing a fixed amount at pre-set intervals such as weekly, monthly, or quarterly. Instead of investing a large sum of money all at once, SIP enables investors to invest smaller amounts consistently, allowing wealth to accumulate gradually. The amount gets automatically deducted from the investor’s bank account and invested in the selected mutual fund scheme without manual effort.

For example, if an investor starts a SIP of ₹2,000 per month in an equity mutual fund and continues for several years, the invested amount grows with the power of compounding and market performance. SIP makes investing as easy as saving money in a bank account, but with the potential for much higher returns. One of the strongest advantages of SIP is that investors do not need expert stock market knowledge. With time, consistency, and patience, SIP can create substantial wealth even from small contributions.

How Does SIP Work in Mutual Funds?

The working mechanism of SIP is simple and automated. Once an investor selects a mutual fund and registers the SIP instructions, a fixed amount gets debited from the bank account on a specific date every month and invested in mutual fund units. The number of units allocated depends on the NAV (Net Asset Value) of the fund on the purchase date. If the market is low, the NAV is lower, so the investor receives more units. If the market is high, the NAV is higher, and the investor receives fewer units. Over time, this balancing effect averages out the overall cost of investment. This process is known as Rupee Cost Averaging.

Another powerful element of SIP is compounding, which means earning returns on both the invested amount and previously accumulated returns. Compounding works best when investments are held long-term. The longer the duration, the higher the final growth. SIP rewards patience and consistency rather than market prediction skills. In simple words, SIP helps investors accumulate wealth gradually without worrying about short-term market fluctuations.

Benefits of SIP Investment in India Benefits of SIP Investment in India – What is SIP Explained

There are numerous advantages that make SIP one of the most preferred methods of investment in India. One of the biggest benefits is the power of compounding. When an investor continues investing over many years, returns grow exponentially instead of linearly. For example, if someone invests ₹3000 per month for 10 years with an expected annual return of 12%, the total investment of ₹3,60,000 grows to approximately ₹6,96,000 due to compounding. This shows that patience and discipline can double your money without additional effort.

Another advantage is Rupee Cost Averaging, which reduces the impact of market volatility. Since investors buy units regularly regardless of price movements, they automatically accumulate more units at lower prices and fewer at higher prices. This reduces risk and eliminates emotional decision-making.

SIP also develops disciplined saving habits. Instead of spending first and saving later, SIP ensures Money is invested before being spent, creating financial control. SIP is extremely affordable, as investors can start with as little as ₹100 per month. It is flexible, easy to manage, and can be increased, paused, or stopped anytime without penalties. SIP is also one of the best ways to achieve long-term goals such as education planning, retirement planning, marriage funds, home purchase, foreign travel funds, emergency reserves and wealth protection.

Types of SIP in India

There are several types of SIP options available for investors depending on financial needs and income patterns.

Regular SIP involves investing the same amount each month.

Step-Up SIP increases the SIP amount automatically every year based on salary growth.

Top-Up SIP allows manual increase in investment whenever possible.

Flexible SIP allows changing the SIP amount based on financial situation.

Goal-Based SIP is designed for specific goals such as buying a home or children’s education.

These types provide customization and help investors stay aligned with their financial objectives.

Types of Mutual Funds for SIP Investment

SIP investments can be made in different mutual fund categories depending on risk appetite and investment duration. Equity mutual funds invest in stocks and offer higher returns over long periods, typically ranging between 12% and 18%. Debt mutual funds invest in safer instruments such as government securities and corporate bonds, offering stable returns between 6% and 8%. Hybrid funds combine both equity and debt, providing balanced returns between 8% and 11%. Index fund SIPs track major market indexes like Nifty and Sensex, offering stable growth between 10% and 14%.

Selecting the right mutual fund depends on investment horizon, risk tolerance, and financial goals.

Legal compliance, mutual fund regulations & investor safety –https://investor.sebi.gov.in

SIP vs Lump Sum Investment

SIP is highly suitable for beginners or individuals who have regular income, as it allows small monthly contributions and eliminates the need for market timing. Lump sum investment is ideal for experienced investors who already have a large amount of capital and strong knowledge of market cycles. SIP carries lower risk and reduces stress because it spreads investment over time. Lump sum investment involves higher risk because investing a large amount at the wrong time may lead to significant losses. Therefore, SIP is considered more reliable and safer for most investors.

Who Should Invest in SIP?

SIP is an excellent choice for anyone who wants to build long-term wealth. It is suitable for salaried individuals, freelancers, students, homemakers, small business owners, and first-time investors. SIP is especially beneficial for people who want financial stability and want to create savings for important life goals. With SIP, even individuals with limited monthly income can start investing and develop confidence in financial planning. It transforms savings into systematic wealth creation.

How to Start SIP in India: Step-by-Step Guide

Starting SIP in India is extremely simple. First, define financial goals based on personal priorities such as retirement, education, marriage, or emergencies. Second, choose the investment duration such as short-term, mid-term, or long-term. Third, research and select a suitable mutual fund scheme. Fourth, complete KYC by submitting Aadhaar, PAN, and bank details. Fifth, invest through online platforms such as Groww, Zerodha Coin, Paytm Money, Upstox, Kuvera, or ET Money. Finally, automate monthly auto-debit and remain invested for long-term results.

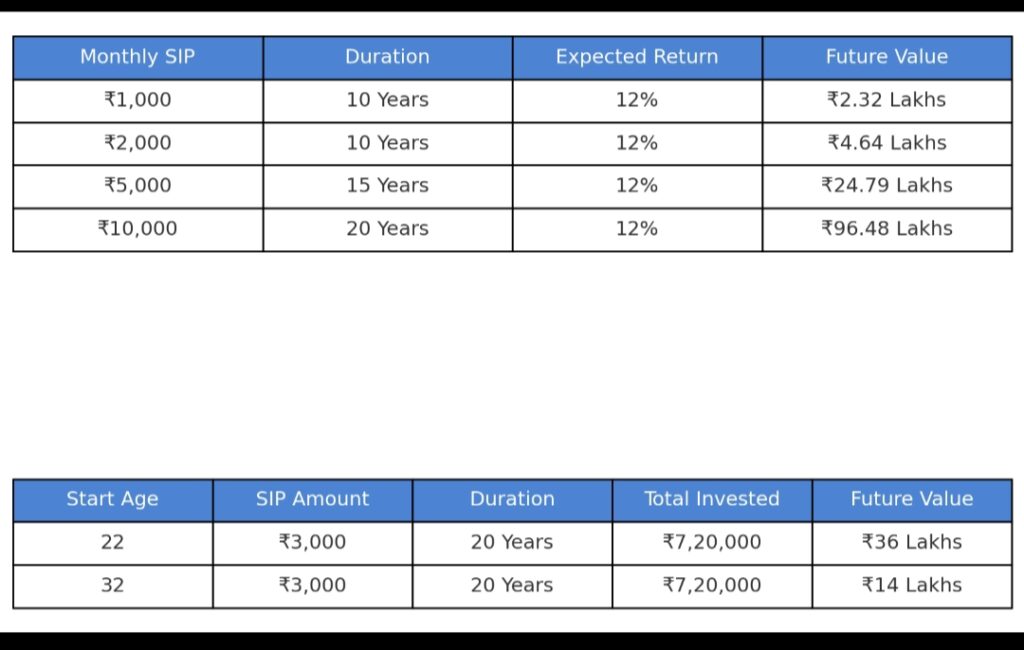

How Much Return Can SIP Provide? Example Calculations

SIP returns depend on investment duration and expected annual return. A SIP of ₹1,000 per month for 10 years at 12% returns approximately ₹2.32 lakhs. A SIP of ₹2,000 for 10 years grows to ₹4.64 lakhs. A SIP of ₹5,000 for 15 years grows to ₹24.79 lakhs. A SIP of ₹10,000 for 20 years grows to nearly ₹96 lakhs. This demonstrates the tremendous power of compounding and long-term investing discipline.

Common Myths About SIP

There are several misconceptions regarding SIP. Many people believe SIP is only for rich individuals, but SIP is actually designed to help ordinary investors begin with small contributions. Some assume SIP guarantees fixed returns, which is incorrect because SIP is market-linked. Others believe SIP works only during rising markets, but SIP benefits more when markets fall due to lower NAV accumulation. People also wrongly expect short-term profits, whereas SIP is designed as a long-term investment strategy.

Mistakes to Avoid While Investing in SIP

The biggest mistake is stopping SIP during market crashes. This eliminates the opportunity to buy units at lower prices. Another mistake is expecting quick profits, which leads to disappointment. Choosing funds without research or comparing SIP returns with fixed deposit rates are also common errors. The most important principle is to stay invested long enough to allow compounding to work effectively. SIP success depends more on discipline than market expertise.

Best SIP Investment Strategy for High Returns

The most effective strategy is to start SIP early and continue consistently. Increasing the SIP amount every year significantly boosts returns. Staying patient during market downturns is crucial. Avoid emotional decisions and maintain a long-term perspective. Investments should ideally be held for a minimum of 5 to 10 years to achieve strong returns. The key principle is simple: time in the market is more important than timing the market.

Advantages of Starting SIP Early

Starting SIP early gives greater advantage because compounding multiplies wealth dramatically over longer periods. For example, starting a SIP of ₹3,000 per month at age 22 for 20 years at 12% returns results in around ₹36 lakhs. Starting at age 32 for the same duration results only in ₹14 lakhs. A delay of 10 years reduces the final value by approximately ₹22 lakhs, proving that time is the most valuable resource in investing. The earlier you start, the greater the wealth you can build.

SIP for Different Financial Goals

Different goals require different SIP strategies. Debt SIP is suitable for emergency funds because it offers stability and liquidity. Equity SIP is ideal for retirement planning due to long-term growth potential. Hybrid or equity funds are suitable for children’s education. Short-term funds are recommended for travel or short goals. SIP helps convert dreams into achievable financial targets.

Taxation and Regulation in SIP

SIP investments are regulated by SEBI, which ensures transparency and investor protection. Equity mutual funds attract long-term capital gains tax at 10% when profits exceed ₹1 lakh in a financial year, applicable only after one year of holding. Short-term gains are taxed at 15% if units are sold before one year. Debt funds follow slab-based taxation. SIP itself is not taxed until units are sold, making it tax efficient and investor friendly.

Click to know about full article ..Income tax saving tips legally

To reference taxation on SIP and capital gains-https://incometaxindia.gov.in

Real Example Case Study: SIP Success Story

Consider an investor named Rohan who started a SIP of ₹5,000 per month at age 25 with an expected return of 12%. By age 45, he would have invested ₹12 lakhs. Due to compounding, his investment would grow to nearly ₹49 lakhs. If he continues until age 55, the total value becomes nearly ₹1.05 crore. This example proves how consistent discipline and long-term patience generate massive wealth.

Frequently Asked Questions (FAQ) About SIP

Q1. What is SIP in simple words?

SIP (Systematic Investment Plan) is a method of investing a fixed amount regularly in mutual funds. It allows investors to contribute small amounts every month rather than investing a large amount at once. It helps build wealth gradually through the power of compounding.

Q2. Is SIP safe for beginners?

Yes, SIP is considered safe and suitable for beginners because it spreads investments over time, reduces risk through rupee cost averaging, and removes the need to time the market. Staying invested long term helps reduce volatility and grow wealth steadily.

Q3. What is the minimum amount required to start SIP?

SIP can be started with as little as ₹100 or ₹500 per month depending on the mutual fund platform. This makes it affordable for students, salaried employees, and new investors.

Q4. How much return can I expect from SIP?

Returns vary depending on the type of mutual fund and market conditions. Historically, equity SIPs have given average returns between 10% to 18% annually over the long term.

Q5. Is SIP better than FD or RD?

Yes, SIP generally provides higher returns compared to Fixed Deposits (FD) or Recurring Deposits (RD) which typically offer 5% to 7%. SIP returns are market-linked and grow significantly over long periods because of compounding, whereas FD returns are fixed and lower.

Q6. Can I stop or pause SIP anytime?

Yes, SIP offers full flexibility. Investors can pause, stop, increase, or decrease the SIP amount anytime without penalties. This makes SIP more flexible than insurance plans or fixed deposits.

Q7. What happens if I miss a SIP payment?

Missing a SIP payment does not cancel your investment. The SIP will continue automatically in the next cycle as long as the bank account has funds. However, repeated failures may require you to restart the SIP mandate.

Q8. Which SIP is best for beginners in India?

Equity mutual funds and index funds are considered good choices for long-term beginners due to stable growth and strong historical performance. Examples include Nifty 50 index funds and large-cap equity funds. However, fund selection should match goals and risk profile.

Q9. How long should I invest in SIP?

For the best results, SIP should be continued for at least 5–10 years or longer. The longer the investment duration, the higher the compounding effect and wealth creation potential.

Q10. Does SIP guarantee returns?

No, SIP does not guarantee fixed returns because it is linked to market performance. However, historically long-term SIPs have shown strong positive returns and lower investment risk due to cost averaging.

Q11. Can I withdraw money from SIP anytime?

Yes, SIP investments in most open-ended funds can be withdrawn anytime. However, equity mutual funds may have an exit load if withdrawn within one year. Withdrawals after one year usually qualify for lower tax.

Q12. When is the best time to start SIP?

The best time to start SIP is today. Starting early provides more time for compounding to grow wealth significantly.

Q13. Do I need a Demat account to start SIP?

No, a Demat account is not required. SIP can be started using any online mutual fund platform by completing e-KYC.

Click here below 👇 Topics for more information

2.How to control overspending the money

3.How to build an Emergency Fund

Conclusion

SIP is one of the most powerful ways to build wealth sustainably and systematically without stress. It allows anyone to begin investing with small amounts and achieve large financial goals with time and discipline. SIP encourages financial responsibility, eliminates emotional decision-making, and transforms investing into a comfortable long-term habit. Even a small SIP of ₹500 per month can grow into lakhs when given enough time. The key is to start investing early, stay consistent, increase contributions gradually, and remain patient through market cycles.

Successful investors do not attempt to time the market. Instead, they spend consistent time in the market and let compounding perform the magic. If financial independence is the destination, SIP is the most reliable vehicle to reach it. Start your SIP today, believe in the process, stay committed, and witness the power of wealth creation unfold over time

Leave a Reply